Asked by

Verified

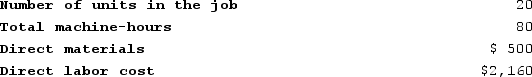

Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed:  The total job cost for Job A496 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job A496 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $2,660

B) $3,104

C) $3,604

D) $1,444

Job A496

A specific, identifiable work task or project within an organization, denoted by its unique job number for tracking and costing purposes.

Total Job Cost

The complete cost of a particular job, project, or order, including all direct and indirect costs such as materials, labor, and overhead.

Predetermined Overhead Rate

A predetermined overhead rate is calculated by dividing estimated manufacturing overhead costs by an allocation base, used to assign overhead costs to products.

- Calculate the cumulative production expenses for specific roles in a job-order costing environment.

Verified Answer

Learning Objectives

- Calculate the cumulative production expenses for specific roles in a job-order costing environment.

Related questions

Assume That the Company Uses a Plantwide Predetermined Manufacturing Overhead ...

Assume That the Company Uses a Plantwide Predetermined Manufacturing Overhead ...

Work in Process Inventory Increased by $20,000 During the Current ...

A Company Used $35,000 of Direct Materials, Incurred $73,000 in ...

Smith Company Reports the Following Information:?Cost of Goods Manufactured$68,250Direct Materials ...