Asked by

Verified

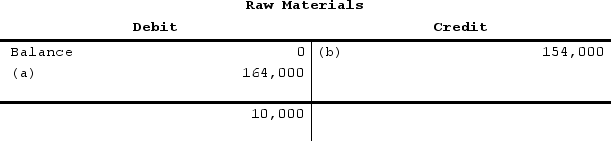

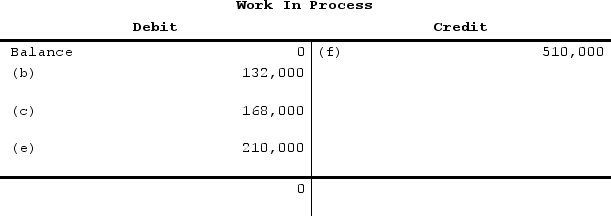

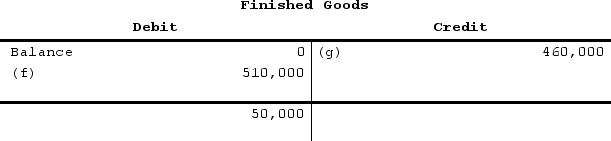

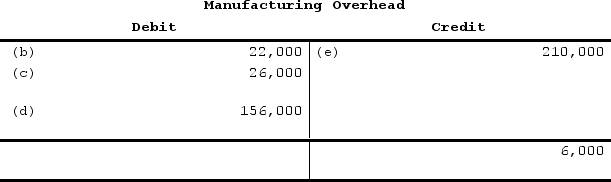

The following accounts are from last year's books at Sharp Manufacturing:

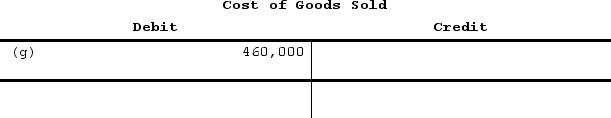

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the amount of cost of goods manufactured for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the amount of cost of goods manufactured for the year?

A) $252,000

B) $454,000

C) $510,000

D) $460,000

Job-Order Costing

A cost accounting system used to accumulate costs of individual jobs, typically used in manufacturing firms that produce unique products or jobs.

Direct Labor Costs

The total cost of wages, benefits, and taxes for employees who are directly involved in the production of goods or services.

Cost Of Goods Manufactured

The manufacturing costs associated with units of product that were finished during the period.

- Identify and calculate cost of goods manufactured from given data.

Verified Answer

Learning Objectives

- Identify and calculate cost of goods manufactured from given data.

Related questions

Solt Corporation Uses a Job-Order Costing System and Has Provided ...

Rediger Incorporated a Manufacturing Corporation, Has Provided the Following Data ...

Tenneson Corporation's Cost of Goods Manufactured for the Just Completed ...

On the Income Statement of a Manufacturing Company, Which of ...

Beginning Work in Process Is Equal to ...